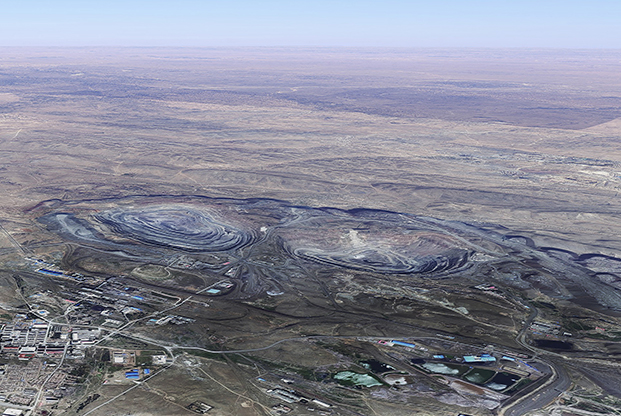

A Chinese rare-earth mine in inner Mongolia. Google Earth

Their names sound as if they are part of some science fiction universe: yttrium, dysprosium, samarium, neodymium. They are rare-earth elements (REEs)—little-known but crucial ingredients in much modern US military aerospace technology.

Take lasers. Lockheed Martin is working on a small, high-power laser weapon that the Air Force Research Laboratory wants to test in a tactical fighter aircraft by 2021. Its active gain medium is a flexible optical fiber infused with a rare-earth element such as erbium or neodymium.

Rare-earth elements are widely used in strong, permanent magnets impervious to temperature extremes. They are used in fin actuators, in missile guidance, and control systems; disk drive motors installed in aircraft and tanks; satellite communications; and radar and sonar systems.

As might be expected given their importance to national security, these elements used to come from the United States. From the 1960s to the 1980s, the US was the global leader in rare-earth mining and production.

That is no longer the case.

In recent decades China has become the source of 90 to 95 percent of world rare-earth oxides and the producer of a majority of the globe’s strongest rare-earth magnets.

Many US officials and lawmakers view this situation with apprehension. They are pushing for solutions that range from stockpiling critical minerals to the development of substitutes and the reopening of key domestic mines.

“It’s a very real concern, and it obviously depends on the elements. But we use them for important technologies to keep us all safe,” said CIA Director Mike Pompeo, in response to an inquiry at a May 2017 Senate Intelligence Committee hearing on worldwide threats to the US.

The rare-earth element group consists of 17 minerals. Fifteen are from a chemical group known as the lanthanides; scandium and yttrium are the other two. All share similar geochemical characteristics, generally resembling the chemical makeup of aluminum. Their slight differences in atomic structure give them different optical, electrical, metallurgic, and magnetic qualities. That makes them useful for a wide array of industrial applications.

Despite their name, rare-earth elements are relatively widespread in the earth’s crust. They are about as abundant as some major metals, such as copper and chrome. Even rare REEs are more common than gold.

Their “rarity” stems from that fact that they are found in low concentrations, up to a few hundred parts per million by weight, at most. That makes it difficult and thus expensive to separate them from surrounding substances into useful products. Development and construction of large-scale rare-earth element recovery infrastructure can take a decade or longer.

While unfamiliar to most Americans, REEs are vital components for a wide array of industries. Their unusual physical and chemical properties produce valuable effects when small amounts are combined with other minerals.

According to a US Geological Survey, yttrium, europium, and terbium are used to make phosphors—substances that emit luminescence—for the flat panel display screens that are ubiquitous in modern electronics. The glass industry is a large user of rare earths for polishing and to provide color and special optical qualities to finished products. Digital camera lenses can be up to 50 percent lanthanum.

REEs are used as catalysts in the production of petroleum and in automotive catalytic converters. They help make lighter flints and fluorescent light bulbs.But their fastest-growing use, and the one arguably most important for US national security, is in lightweight, strong, durable magnets.

“Exceptionally notable is how REE alloys revolutionized the magnet trade and subsequently enhanced the products of all other businesses relying on that industry,” wrote USAF Lt. Col. Justin C. Davey in a 2011 Air War College report. The magnets, and by extension the elements, are now common in consumer electronics and indispensable for many defense applications.

Samarium-cobalt magnets are more resistant to demagnetization than those made from any other material. This quality—called high coercivity—means high temperatures do not make them lose magnetic strength. That makes them the best choice for many military applications, according to Davey.In contrast, neodymium-iron-boron magnets are incredibly strong and light. By weight they are almost 10 times more powerful than traditional ferrite magnets. That makes them ideal for use in the tiny electronic components such as disk drives that have helped make possible decades of computer-driven innovation.

The world’s push for renewable energy sources may only increase the demand for non-renewable REE magnets. A Toyota Prius, for example, uses about two pounds of neodymium in its hybrid power system. Wind turbines need lots of neodymium—new models use up to two tons of neodymium magnets.

The Department of Defense is not a major user of rare-earth elements, relatively speaking. Defense accounts for about five percent of US consumption, according to a Congressional Research Service background report on the subject. But REEs are integral to a vast array of Pentagon weapons and general equipment.

Flat screens and hard drives are pervasive in the military, from office computers to combat aircraft, ships, and vehicles. Missile guidance and control motors and actuators depend on small, powerful rare-earth magnets. If it were not for them, precision-guided weapons such as the satellite-guided Joint Direct Attack Munition would require much bulkier and more expensive hydraulic systems.

The generators that produce electrical power for aircraft all contain samarium-cobalt magnets. The stealth technology that produces white noise to help conceal the sound of helicopter rotor blades uses such magnets as well. F-22 tail fins and rudders move due to motors with powerful, miniature REE magnets. Electronic warfare jamming devices use rare-earth materials, as do laser targeting systems and nascent laser weapons.

Each stealthy F-35 strike fighter requires 920 pounds of rare-earth material, according to DOD. Each Arleigh Burke DDG-51 destroyer requires 5,200 pounds. An SSN-774 Virginia-class submarine needs 9,200 pounds.

The ability of US contractors to quickly make use of technological innovations and translate them into high-quality military systems is a pillar of the nation’s defense. Given that, the Pentagon is likely to become even more dependent in the coming years on high-tech magnets, motors, lasers, computers, and electric-drive systems that use rare-earth materials.

But as noted above, the US itself no longer produces rare-earth ore or processes the substance at early points along the supply chain. Virtually all comes from China.

Dash Parham/Staff

COMMUNIST CHOKE POINT

Chinese leaders, citing domestic needs and environmental effects, have in the past restricted the export of rare-earth supplies through such means as licenses, taxes, and out-and-out quotas.

For instance, in July 2010 China announced it would reduce its exports of rare earths for the second half of the year by 70 percent over the previous year’s levels.

Then on September 7, 2010, a Chinese fishing boat and two Japanese Coast Guard vessels collided in waters claimed by both nations. A few days later The New York Times reported that, in retaliation for the accident, China had begun restricting rare-earth exports to Japan, the world’s biggest user.Beijing resumed its Japanese exports that November. But among US policymakers, worries about the incident have lingered.

It appears that China may view rare-earth elements as akin to the oil in the 21st century—a high-demand product that can be used for many purposes.In Washington these developments have “given rise to concerns that China may attempt to use its control of rare earth as leverage to obtain its political and economic goals”, according to the CRS report.

ALLIES AND ADVERSARIES

Deposits of rare-earth elements are found all around the globe. But according to the US Department of Energy, only a limited number of nations have proven and significant rare-earth reserves. These include Australia, India, China, Russia, Kazakhstan, and the United States.

The US dominated the rare-earth market from the time the substances became important industrial ingredients up to the mid-1980s. The most important US source by far was one mine, Mountain Pass, Calif.

Mountain Pass is located in remote southeastern California, not too far from Arizona and only about 15 miles from the southern tip of Nevada.

Retrieving usable rare-earth elements from open-pit mines such as Mountain Pass is not easy work. The metals are generally found mixed together in deposits that also contain radioactive elements such as thorium. Rock is mined, then crushed into a fine powder, and passed though a series of tanks where the rare earths come to the top and waste material sinks to the bottom.

The waste, which contains hazardous materials, is pumped off to storage ponds. The rare-earth mixture is dried in a kiln and then dissolved in acid. The end result is a sludge that contains a fraction of purer rare earths in the form of mixed metal oxides, which are removed.

The process is messy. When Mountain Pass was running at full capacity it was producing 850 gallons of salty wastewater per minute, which was piped to evaporation ponds 11 miles away. Over the years, thorium and uranium collected as scale inside the pipe. In the 1990s several efforts to scrub the built-up scale broke the pipes instead, spilling large amounts of hazardous material into the environment.

The state of California ordered Unocal, the oil corporation that owned mining firm Molycorp, to clean up the spills. Then in 2002 the company ran out of space to store waste, as its ponds had filled and it was unable to get permits to build new storage. Weakened by poor financial results, the mine closed.

An F-35 drops a 2,000-pound GBU-31 bomb. Each F-35 contains nearly a thousand pounds of rare earth elements. Paul Holcomb/USAF

EMBRACING THE DIRTY WORK

By that time, China had already emerged as the world’s leading REE producer. The largest rare-earth mine, by far, is at Baiyun Obo in the Chinese region of Inner Mongolia. Valuable heavy rare earths are concentrated in areas in southern China such as Hunan and Fujian provinces. The communist nation has almost half the world’s total known rare-earth reserves, according to a CRS report on China’s rare-earth industry and export regime.

Actual Chinese production of rare earths was insignificant until the 1980s. Then it exploded due to improved mining and production techniques and the nation’s lurch away from communism toward a more market-oriented economy. In 1986, China passed the US to become the top rare-earth producer in the world. It has sat at No. 1 in those rankings ever since.

Strong government support, low labor costs, and lax environmental standards are among the reasons for China’s quick and continued domination of the industry, according to some US mining executives and members of Congress. For instance, China has the largest rare-earth tailings pond in the world in Inner Mongolia.

Built in the 1950s, the four-square- mile pond does not have a protective liner. Radioactive waste from the site is gradually working its way toward the nearby Yellow River, a crucial water source for millions.

In the 1990s high profit margins lured many Chinese start-up industries into the rare-earth business. Exports peaked in the mid-2000s, before prices abruptly crashed, pushing some non-Chinese mines—such as California’s Mountain Pass—into bankruptcy.

Since then, Beijing has moved to exert more central control, rationalizing production and taxing and restricting exports. Compared to the low point of 2005, rare-earth prices have risen as supplies tightened. At the same time China has expanded its ability to process raw rare-earth materials into alloys and then into finished products.

According to CRS, China now produces about 90 percent of all rare-earth metal alloys. It manufactures about 75 percent of all neodymium-iron-boron magnets and 60 percent of all samarium-cobalt magnets.

In the context of China’s 2010 restriction of rare-earth exports to Japan, the message here is clear, claim US executives: If rare-earth materials are the oil of the 21st century, China wants to pump the oil, refine the gasoline—and maybe make the car too.

“Critics of China’s rare-earth policies contend that they are largely aimed at inducing foreign, high-technology and green technology firms to move their production facilities to China in order to ensure their access to rare-earth elements and to provide preferential treatment to Chinese high-tech and green energy companies in order to boost their global competitiveness,” concludes the CRS report on national defense and rare earth.

_You can read this story in our print issue:

NATIONAL SECURITY INTERESTS

Given this situation, what is the Pentagon doing to ensure a continued supply of crucial rare earth-derived products? Not enough, say some members of Congress.

On March 28, 2017, the full Senate Committee on Energy and Natural Resources held a hearing on US dependence on foreign minerals, with a focus on rare earths. Chairman Lisa Murkowski (R-Alaska)—a state with rare-earth resources of its own—said she was frustrated by what she heard.

“Instead of lessening our dependence, we are actually increasing our dependence. We have increased it from just last year. We’re not making headway on this issue,” she said.

Congressional interest in this subject is not new. Lawmakers have long urged the Pentagon to take a more organized approach to ensuring security of rareearth supplies, in part as a reaction to the 2010 shutoff of rare earths to Japan. Since at least 2011, defense authorization bills have generally included language directing the Pentagon to identify which rare-earth elements are strategically valuable and ways to plug holes in the rare-earth supply chain.

The Fiscal Year 2012 defense bill also included a provision requiring the Secretary of Defense to report back to Congress on the feasibility of recovering, reprocessing, and recycling rare-earth elements, including those used in the fluorescent lighting of DOD facilities.

Opinions are mixed as to whether the Pentagon has fulfilled these requirements. A February 2016 report from the Government Accountability Office assesses that it has not.

“DOD has no comprehensive, department-wide approach to determine which rare earths are critical to national security and how to deal with potential supply disruptions to ensure continued reliable access,” concluded the GAO study.

The key word there may be “comprehensive”. As the GAO documents, a number of Pentagon organizations work on identifying critical rare-earth needs and possible ways to handle a shortfall. But their work is “fragmented”, according to the study. The Defense Logistics Agency methodically analyzes risks for rare earths, but only over a four-year time frame. The Manufacturing and Industrial Base Policy office relies on others to evaluate risks, and the open market to resolve supply disruptions. The Strategic Materials Protection Board has not developed an overarching framework to mitigate the problem.The DLA does maintain a strategic materials stockpile, which includes some rare-earth elements. In 2016 the agency awarded new contracts for multiyear purchases of yttrium oxide and dysprosium metal.

But pressure to stockpile rare earths may have been eased in recent years by the fact that, on the open market, supplies have loosened.

Since that time “There has been a significant change in the global marketplace concerning rare earths. Increased market supply from a more diversified producer base coupled with decreased demand has led to global surpluses for several rare-earth materials,” according to a September 2016 Annual Industrial Capabilities report from the Under Secretary of Defense for Acquisition, Technology, and Logistics. For much of the decade the cost of REEs has remained relatively stable.

Mountain Pass open-pit rare-earth mine in southeastern California was the nation’s most important resource for rare-earth materials. Google Earth

CHINA RISES

But that has changed recently, with prices gaining around 65 percent from early 2016 to fall 2017. And investors may see more price in the future as demand increases due to the rise of green energy and the spread of electric vehicles. Demand for dysprosium, for instance, could increase by 2,600 percent over the next 25 years as wind turbines and electric motors proliferate, according to an MIT study.

In this context, government ownership of the Mountain Pass mine in California might be a good idea, say some industry officials.

In July 2017, Michael N. Silver, head of American Elements Corp., met with White House officials in an effort to get them interested in such a takeover. (An effort to restart Mountain Pass flopped in 2015, due to another bankruptcy. The mine has since been bought by a group of firms, one of which allegedly has ties to the Chinese government.)

For the longer term, US national labs are studying the possibility of extracting rare-earth elements from coal and coal by-products. Current US coal reserves contain about a 1,000-year US rare-earth elements supply, at current consumption levels, according to the US National Energy Technology Laboratory.

“I think we are at a point in this country—and this is something we’ve talked about on this committee—[where we need] to develop a rare-earth national security policy for the United States. … We would be foolish if the American government didn’t come together and say, we are going to procure and secure the rare-earth metals needed from us instead of having to depend on any other country,” said Rep. Ted Yoho (R-Fla.), chairman of the House Foreign Affairs Subcommittee on Asia and the Pacific, at an April 26, 2017, hearing.For the time being, however, defense lasers, batteries, displays, magnets, and other components—thousands of pounds of rare-earth elements in some advanced weapons systems—will continue to be purchased in a volatile marketplace dominated by one nation, China.

_Peter Grier, a Washington, D.C., editor for The Christian Science Monitor, is a longtime contributor to Air Force Magazine. His most recent article, “Misplaced Nukes,” appeared in the August 2017 issue.